For about two decades, ASI has been helping to build cross-Atlantic bridges between the North American promotional products industry and its counterpart market in Europe.

ASI leaders have been active facilitating transcontinental relationship-building and providing in-person, boots-on-the-ground media coverage for Europe’s major trade shows like Germany’s PSI Show and the United Kingdom’s Merchandise World.

Then there’s PromoAlliance, an international alliance for the promotional products industry that involves ASI, Sourcing City – which is a trade service organization that provides a suite of solutions for the U.K. promo market – and Promotional Product Service Institute (PSI), Europe’s largest business network for the merch industry.

Amid all the intercontinental activity and conversations over the years, one pivotal question has consistently reared: Just how big is the European promotional products market?

It’s a question that industry executives on both sides of the Atlantic have been asking even more frequently of late as the merch business has become increasingly globalized.

Now, there’s an answer.

Leveraging its extensive relationship network across the pond and digging deep into number-crunching, ASI has developed a data-backed estimate for total promo product distributor sales in the United Kingdom and the European Union (EU). According to the study from ASI Research, combined distributor sales were $12.48 billion in 2022 – a figure that accounts for apparel and hard goods business.

A bit less than half the size of the $25.8 billion North American merch market, the figure tallies total sales in the four countries in the U.K. and the 27 nations that belong to the supranational political and economic union known as the EU. Estimates for some countries, such as Germany and the U.K., have been made previously but rarely has there been a comprehensive study of the United Kingdom and European Union combined.

$12.48 Billion

Annual promo distributor sales in the United Kingdom and European Union in 2022.(ASI Research)

“As our industry continues to grow and companies expand internationally, both organically and through acquisitions, we’ve been repeatedly asked for data on the European market, similar to what exists in the North American market,” explains Nate Kucsma, ASI’s senior executive director of research.

“Up until now,” Kucsma continues, “this didn’t exist on a consistent U.K./European Union-wide basis. That needed to be addressed. Estimates are important because they allow companies to understand the size of an addressable market and where they fit within that market. As we continue to monitor industry growth, businesses can evaluate their company’s growth versus the industry as a whole.”

$10.48 Billion

Annual promo distributor sales across the 27 nations in the European Union in 2022.(ASI Research)

To determine market size, researchers used the North American market as a sales benchmark. Among other things, this included determining promo’s percentage of overall advertising spend in the United States.

With North American benchmarks in mind, ASI developed an algorithm that incorporated evaluations of gross domestic product per capita, advertising spend per capita, and the number of small and-medium-sized businesses in every European country assessed. Researchers applied the resulting formula to determine total promo spend estimates for the U.K. and each European Union nation, then added those up to get a combined total.

$2 Billion

Annual promo distributor sales in the United Kingdom in 2022.(ASI Research)

“The hard part was developing the calculations and refining the estimates,” Kucsma shares. “Now the fun part begins, which is gauging reactions to this intensive deep-dive study and refining the estimates as we move forward.”

As Kucsma alludes to, the study is about more than a topline revenue number. It also spotlights which individual European countries spend the most on promo overall and per capita, as well as branded merchandise revenue as a percentage of each nation’s gross domestic product. Additionally, experts on the European market spoke with ASI Media to offer anecdotal insights on product trends, end-markets, the importance of sustainability, and the impacts of Brexit.

The Big Four

There are four national markets in Europe in which distributors generate more than $1 billion in sales annually – Germany (nearly $3.1 billion), the United Kingdom ($2 billion), France ($1.68 billion) and Italy ($1.5 billion). The fifth largest national market is Spain ($566 million) – which, in terms of sales, is a bit more than a third of the size of fourth place Italy.

Perhaps not surprisingly, the big four have the largest economies in the U.K./European Union zones and are among the most populous nations on the European continent. Clearly, such factors contribute to the higher spend on promo.

So does the fact these nations are home to diverse industries, major corporations/international brands, competitive small to-medium-sized businesses and, generally speaking, are informed by business cultures that value and invest in strategic marketing and advertising, promo leaders say.

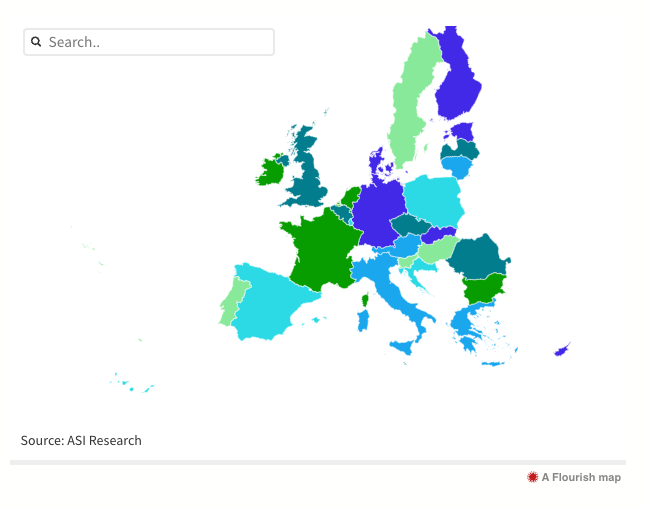

Promo Sales Across Europe

Spending on branded apparel and hard good promo products in the United Kingdom and the European Union totaled an estimated $12.48 billion in 2022, according to ASI Research. There are four nations in which annual spend surpassed $1 billion: Germany, the United Kingdom, France and Italy. Rounding out the top ten biggest spenders are, in order, Spain, Sweden, Denmark, Belgium, Netherlands and Austria. This interactive map shows total promo spend and promo spend per capita in each studied nation.

Click the map to see individual country estimates.

“Germany, the U.K., France and Italy are not only big in economic terms; they’re also quite entrepreneurial,” says John Lynch, the American-born CEO and founder of Krakow, Poland-based Lynka, one of Europe’s leading producers and suppliers of imprinted activewear, corporate clothing and accessories, which in 2021 became part of Top 40 supplier Vantage Apparel (asi/93390).

“Take the U.K.,” continues Lynch, who was Counselor’s 2022 International Person of the Year. “Similar to the United States, it’s a very marketing-driven, brand-identity obsessed country. Every small pub, school, club and organization does their own branded merchandise, and has been doing so for at least 20 years.”

The allure of Europe’s leading markets has increasingly attracted North American distributors.

In 2018, Lewiston, ME-based Top 40 distributor Geiger (asi/202900) made its first acquisition in the United Kingdom and since then has made four others, including most recently Leatherhead, England-based Firebrand Promotions in July.

Meanwhile, Woodinville, WA-based Top 40 distributor BDA (asi/137616) already had offices in the U.K. and France, along with a distribution center in the Netherlands, when in late June it expanded its footprint to Germany with the acquisition of ipm | gruppe – one of promo’s most significant distributors in that country of more than 83 million people.

Jay Deutsch, CEO of Top 40 distributor BDA, discusses the firm’s acquisition of Germany-based ipm | gruppe in this Promo Insiders podcast, as well as growth opportunities in the German market – and Europe more broadly.

The deeper push by U.S. distributors into the European market is a phenomenon driven both by a desire to meet enterprise clients’ needs in North America and Europe, as well as by a belief that there are ample opportunities to capture new business once established in the U.K./European Union.

“We want to be a full-service branded merchandise agency and supply chain management partner to our clients across geographies,” says BDA CEO Jay Deutsch, a member of Counselor’s Power 50 list of promo’s most influential people. “Having boots on the ground in the countries where they need solutions helps that effort tremendously and creates additional growth potential.”

Jo-an Lantz expresses a like-minded perspective.

“Many of the world’s largest brands rely on our services to meet their entire branded apparel and branded merchandise requirements,” says Lantz, president and CEO of Geiger and a Power 50 member. “Our expansive distribution centers and local sales force play an important role in delivering prompt, localized service to customers who operate on a global scale.”

‘Smaller, Richer’ Countries Have High Per-Capita Promo Spend

Make no mistake: There’s significant promo business occurring beyond the billion-dollar big four markets, too. ASI Research’s analysis of promo spend per capita and promo spend as a percentage of GDP evidences that.

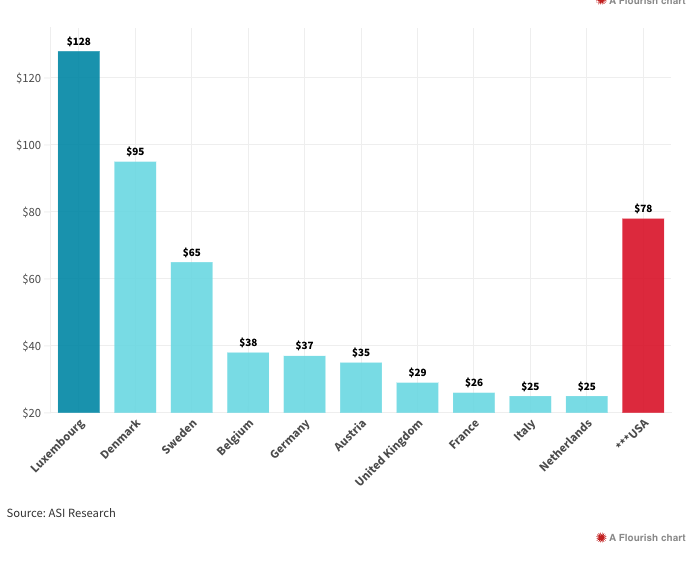

According to ASI Research: Luxembourg, a country of about 660,000 people, led the way on per-capita promo spend at $128. It was followed by Denmark ($95), Sweden ($65), Belgium ($38), Germany ($37), Austria ($35) and the United Kingdom ($29).

Top 10 Countries for Promo Spend Per Capita

U.K./European Union

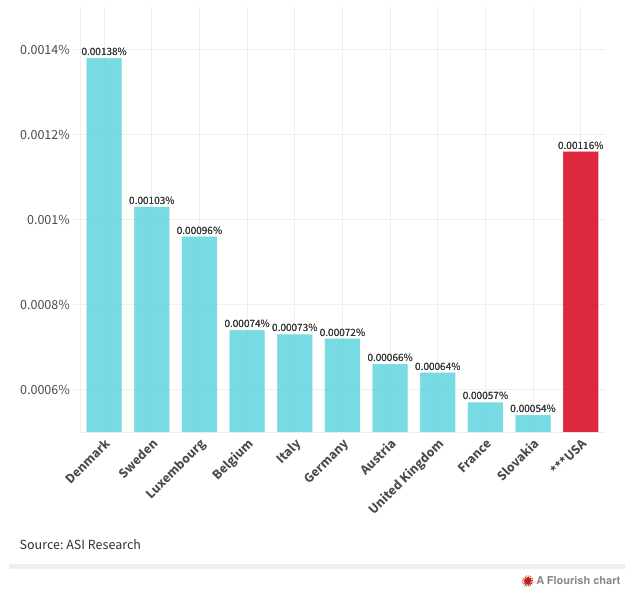

When it came to branded merch spending as a percentage of a nation’s GDP, the top countries looked about the same: Denmark (0.00138%), Sweden (0.00103%), Luxembourg (0.00096%), Belgium (0.00074%), Italy (0.00073%), Germany (0.00072%), Austria (0.00066%) and the U.K. (0.00064%).

While the U.K. and Italy, like Germany, are large population-wise in European terms with about 68 million and 59 million people respectively, the other countries (besides Luxembourg) have populaces in the range of about six million to nearly 12 million. What’s driving the relatively robust promo spending in those nations?

“These countries generally have higher income levels and higher standards of living,” explains Miles Lovegrove, managing director at Fluid Branding (asi/195718), a U.K.-headquartered distributor that does business throughout Europe. Lovegrove, who was named one of Counselor's 2021 International People of the Year along with fellow Fluid Branding owner Matt Franks, continues: “The populations’ higher purchasing power enables individuals and businesses to invest more in promotional products and other marketing initiatives.”

There appear to be related factors, too, including strong business cultures, the presence of thriving small and-medium-sized businesses that rely on promo as a cost-effective marketing tool, the hosting of trade shows/exhibitions/events, and an emphasis on quality, executives say.

“Scandinavian countries like Denmark and Sweden, as well as countries like Belgium and Austria, have a strong design culture and value high-quality products,” Lovegrove says. “This appreciation for aesthetics and craftsmanship extends to promotional products, where there’s a demand for well-designed, premium items.”

Another important accelerator of promotional product spending in places that include certain of Europe’s more affluent northerly and central countries appears to be a cultural emphasis on building personal and professional relationships through gift-giving, according to industry leaders. This could be helping to fuel promo spending in places like Belgium, Austria, Germany and elsewhere.

“You have seasonal giving around Christmas and Easter, for example, that’s very important on the corporate side and promotional products are part of that,” says Michael Freter, a promo industry veteran and event organizing executive who was Counselor magazine’s 2020 International Person of the Year.

Geiger has seen this tradition in action. Lantz says the Top 40 firm has generated significant business fulfilling gift baskets with branded goods that often include food items and a wine/kitchen-related present, among other things, for clients. “We’ve really seen the demand for this type of gift-giving in northern countries – Germany, Belgium and Netherlands especially,” Lantz says.

Sustainability Is Paramount

David Long calls it the “big one.”

The founder/executive chairman of Sourcing City is referring to a phenomenon that’s occurring across many national borders in the European promotional products industry.

He’s talking about the broad push by suppliers and distributors to operate in a manner that reduces environmental impact and to sell products that can be proven to be more eco-friendly than their traditional counterparts.

“Just about every supplier – manufacturer and wholesaler – is extremely focused on sustainability and pretty much every new product launched has eco-credentials,” says Long.

Marcus Sperber gives a similar account.

“Sustainability is the keyword right now,” says Sperber, co-CEO/managing director of Germany-based elasto GmbH & Co. KG (asi/51817), one of Europe’s biggest suppliers. “Everything should be made of eco-materials, recycled or recyclable – or all of it, if possible. Also, it’s not just the product itself anymore. The whole production process is often required to be more sustainable. Buyers want products made without carbon footprint and climate-positive production.”

“Just about every supplier – manufacturer and wholesaler – is extremely focused on sustainability and pretty much every new product launched has eco-credentials.” David Long, Sourcing City

While a sustainability emphasis has grown in the North American market, promo Europe is approximately a decade ahead when it comes to eco-efforts, industry observers say.

In part, that’s been driven by necessity: End-buyers across the pond are simply demanding the greener approach. Consider: The WA-Monitor, an analytical report of the promo market produced by the General Association of the German Promotional Product Industry, found that “sustainability” plays a decisive role for 91% of companies when purchasing promotional products.

“Buyers in Europe are interested in products that are produced ethically and sustainably,” says Lovegrove. “This means considering the manufacturing process, supply chain transparency and fair labor practices. They’re also looking for products made with environmentally friendly materials. This includes items made from recycled materials, organic or sustainable fabrics, biodegradable or compostable materials, and products with reduced carbon footprints.”

Many end-buyers also care about using minimal packaging and/or recyclable or biodegradable packaging materials, as well as whether or not a promo firm is supporting environmental initiatives and engaging in carbon offsetting. Products that are reusable and have longevity are especially sought-after.

91%

Percentage of companies who say “sustainability” plays a decisive role when purchasing promotional products.(General Association of the German Promotional Product Industry)

Amid such demand, promo firms are increasingly seeking and obtaining certifications and verifications that prove they’re making genuine progress on sustainability. Geiger, for instance, has earned high marks from EcoVadis, which assesses businesses on the quality of their sustainability practices. Sustainability assessments from entities like Bluesign matter, too. At the PSI Show and Merchandise World, suppliers have been keen to emphasize not only the sustainability story of their products but also their company’s sustainability/corporate social responsibility credentials.

“Sustainability has become an integral part of the promotional products industry,” says Petra Lassahn, the managing director of the PSI Show.

While sustainability is generally a big deal, the exact degree of its importance varies from country to country – not a surprise in a place as culturally diverse as Europe. Countries where sustainability carries the most relevance include Germany, Netherlands, and the Nordic nations of Denmark, Sweden, Norway and Finland. Compared to those countries, buyers in Italy, Spain, Greece and Portugal may, in general, place relatively lower emphasis on eco, though that’s certainly not to say that the green focus isn’t there, executives say.

“Sustainability awareness and practices in some Eastern European countries may still be developing compared to Western and Northern European countries,” Lovegrove shares. “However, sustainability initiatives are gradually gaining attention and importance across the region.”

Bottom-line: Eco matters in Europe, and its importance will grow.

Apparel on the Rise?

In North America, apparel rules the product roost.

Sales of wearables, including various shirts, headwear and outerwear, account for 46% of promo industry sales, according to Counselor’s 2023 State of the Industry Report. In the U.K./European Union, apparel/wearables comprise about 20% of promo market sales, ASI Research shows.

Cultural differences could be one reason for the difference. A more casual clothing culture in North America in which it’s long been commonplace to show one’s association with a team, school, organization and business through decorated apparel is a likely factor.

Relatedly, there’s a ball cap-wearing preference in North America that hasn’t traditionally existed in Europe, which helps drive headwear sales for distributors in the U.S. and Canada. Stricter regulations/compliance requirements in Europe related to apparel may also account for the continental difference, as could the fact that, broadly speaking, fashion-forward dress carries greater relevance in Europe and individuals may be less inclined to don logowear that doesn’t meet their personal style criteria, according to executives with whom ASI Media spoke.

About 20%

Percentage of total distributor sales accounted for by apparel in the U.K. and European Union.(ASI Research)

Nonetheless, European promo leaders say sales of wearables are on the rise in both the U.K. and the European Union.

“Demand for branded apparel and workwear is catching up in Europe, with brand names and higher-quality products required especially,” says Sperber. “Companies here are paying more attention to brand-building and their image. Buyers are realizing apparel offers a very good opportunity to help with that.”

Freter agrees. “Workwear, or company-branded clothes, is definitely a growing market in Europe. It’s not on the scale of North America, but it is growing,” he says.

Lynch, whose Lynka is an apparel supplier, has witnessed a definite increase in logoed apparel interest across a number of national markets in Europe. He says that many small and medium-sized businesses are “rapidly adopting uniforms as the standard,” as one example. But that’s not all. Sales of hooded sweatshirts have soared in recent years. Outerwear styles, brands and designs are expanding, he adds.

“One thing with apparel in Europe,” notes Lantz, “is that the branding has to be subtle. People don’t want to walk around wearing a massive logo.”

When it comes to other product preferences in Europe, Lovegrove sums up the assessment of many when he says there are a few categories that tend to be widely popular – and they’re not dissimilar to North America. “While there might be some variations by country and between the U.K. and the continent, there are some commonly sought-after products,” he states.

That includes drinkware, which as it happens is the second highest-sales-generating category for promo in the U.S./Canada. “Items like mugs, tumblers, water bottles and reusable cups are popular in Europe,” says Lovegrove. “These products offer practicality, usability and a wide range of customization options, making them ideal promotional items.”

“Demand for branded apparel and workwear is catching up in Europe, with brand names and higher-quality products required especially.” Marcus Sperber, elasto GmbH & Co. KG

Meanwhile, bags that include totes, backpacks and laptop styles are commonly used as promotional merchandise. “Reusable shopping bags, in particular, have gained popularity due to their eco-friendly nature,” notes Lovegrove, with Lantz agreeing and adding: “Beyond totes, backpacks have been very popular with our clients.”

Long shares that the U.K. market tends be keen for bags and pens, which in North America are among the top 10 product categories too. Tom Robey, membership director with the British Promotional Merchandise Association, a trade body serving the U.K. promo products industry, says bags, writing instruments, mugs, sports bottles and confectionery generated the most product enquiries in 2022.

Similarly, Freter says writing instruments and notebooks are big in Germany. “Pens and other writing instruments remain popular throughout Europe,” says Lovegrove. “These practical and inexpensive products can be easily customized and are often used in various settings.”

In North America, ASI Research shows that mobile technology accessories and electronics/USBs/computer-related products accounted for nearly 5% of total distributor sales in 2022. While an exact number wasn’t available for Europe, promo pros there say tech items are among the more popular offerings in both the U.K. and European Union. “Products such as power banks, USB drives, phone accessories, and tech gadgets have a broad appeal across different age groups,” says Lovegrove.

Sperber, who says drinkware and stationery tend to be highly popular sellers, notes there’s also been rising buyer interest in products made closer to home. “The demand for locally produced goods is increasing in many categories,” Sperber shares. “A decoupling with Asian-made products is appreciable.”

End-Market Insights

Exact macro data on the end-markets in which U.K. and European Union distributors generate their highest percentages of sales is tough to come by. Europe is not a homogenous entity, and Sperber and others note that which end-client markets invest most robustly in promo is similar but could vary in the exact percentages and particularities from individual nation to nation.

Still, executives say there are observable general trends – and they’re similar to what’s seen in North America.

In the U.K., for instance, “a vast range of sectors rely on branded merchandise to support their marketing,” says Robey. “They include hospitality and events, food and beverage, financial organizations, healthcare, nonprofit entities and companies in the technology industry.” Long, of Sourcing City, adds that “corporate organizations tend to be the largest spenders” in the U.K.

In regard to both the U.K. and EU markets, Lovegrove concurs that corporations and various service industry clients “have a consistent demand for promotional items. Businesses across various sectors, including finance, consulting, technology and professional services invest in promotional products for brand promotion, client gifts, employee recognition and event giveaways.”

Speaking from his perspective as an apparel supplier that does business on the continent and in the U.K., Lynch observes that some of the most significant purchasing of promo in Europe is done by the technology, automotive, consumer packaged goods, and petrochemical/chemical industries. Gastronomy-related entities like restaurants and pubs are also committed promo buyers, Lynch maintains.

“Businesses across various sectors, including finance, consulting, technology and professional services invest in promotional products for brand promotion, client gifts, employee recognition and event giveaways.” Miles Lovegrove, Fluid Branding

Sperber notes that businesses connected with summer-related tourism can prove avid purchasers of promo in nations like Italy and Spain where Europeans and others flock for vacations in the warm months. Luggage tags, travel accessories and beach-themed merchandise are among products purchased to enhance guest experiences, promote destinations and encourage brand loyalty, according to executives.

“In other countries, like Germany, the spending can be more driven by big events and exhibitions,” Sperber says. Indeed, as in the U.S. and Canada, trade shows and events propel considerable promo spend in Europe through large orders for giveaways and booth materials.

In North America, education and healthcare are the two most fertile markets for promo sales. Distributors in Europe are finding success with such clients, too.

Educational institutions, schools, universities, and nonprofit organizations often utilize promotional products for fundraising, student recruitment, brand recognition and promoting causes. “This sector may have specific needs for items like branded stationery, apparel or accessories,” notes Lovegrove.

Meanwhile, healthcare providers, hospitals and related organizations utilize promotional products for marketing campaigns, patient giveaways, healthcare events and awareness initiatives. “Clients in this sector often require specialized healthcare-related promotional items,” according to Lovegrove.

Elsewhere, retailers, e-commerce businesses and consumer goods companies leverage promotional products for brand reinforcement, customer loyalty programs, product launches and in-store promotions.

“While various economic factors can influence short-term performance,” Kucsma says, “we believe the overall trajectory of the U.K. and European Union promo markets is one of growth.”

“Brexit has been one big disaster for the promotional products industry on both sides of the English Channel.” John Lynch, Lynka

“Brexit has been one big disaster for the promotional products industry on both sides of the English Channel.” John Lynch, Lynka

Want to learn more about PromoAlliance?

Request Info